To begin with, this blog is aimed at real estate investing for beginners as well as pros. All those real estate investors and owners who are always looking for practical ways to increase their real estate income but don’t know where to take the first step.

I’m going to provide a step-by-step guide on exactly what you can do to multiply your real estate investment income fast.

But, keep this in mind: I’m not going to discuss how to invest in property in the first place!

This blog is for those who already own some kind of property — and ideally, a multi-unit building — but don’t know how to utilize it to its full potential and squeeze maximum cash out of it!

So, if you own some real estate and believe that you’re earning way under what you should actually be earning, buckle up…

The seven steps or strategies below can prove a game-changer for you in your quest to maximize your property income!

Thrilled, right? No more talk, let’s get started!

1) Aim at a 100% Occupancy Rate

Set your aim right! Aim right and shoot OR you’ll miss your target. Most real estate owners never aim right. What they do is, aim at filling up ‘most’ of their units but not 100% of their units.

This attitude sets you off on the wrong track from the start…

Don’t be complacent with how much of your building is occupied but plan to get 100% of the property occupied by high-paying, long-term residents.

What I mean to say is, if you own a 20-unit building and 15 of them are occupied you’ll have a tendency to lie back and count the rent money. Don’t do it! Don’t become complacent!

Because 5 of your apartments are still vacant and they aren’t supposed to be.

They add to your costs and pay nothing in return… what’s happening is that your assets have turned into a liability for you.

So plan diligently and make every effort to get them all filled up from the get-go!

2) Upgrade Your Property Management!

Most property owners who are not able to generate enough returns on their property investment USA will think it has got something to do with the property or its location.

But, the truth is… ‘the underperformance of your property has not much to do with its location or neighborhood.’ (Because haven’t you and I seen fully occupied buildings in the worst neighborhoods? Then why blame the location?)

The bigger truth is that making just little changes to your management style can do wonders for you.

A lot of property owners neglect the management part of their job and wonder what keeps the riches from floating in… Yup, it’s THAT important.

Now, what can you do to manage your property well?

A Few Easy And Actionable Points

– Keep the residents happy! Don’t neglect them. Organize meetings where the residents can voice their concerns and make sure to fix their issues. Because happy tenants mean happy returns!

– Deal with the defaulters! Don’t put up with them and never be lenient with the tenants who pay late. Never forfeit the fee for late payments, if you do you’ll spoil them!

– Consult a qualified tax agent and see if there’s a possibility that you’re paying the tax more than is necessary. Or if there are any legitimate ways you could save on tax (and usually there are plenty…)

– Invest some amount in beefing up the security of the building (install CCTV cameras, etc.), and in return, you can easily raise the rent.

– Carry out maintenance checks every once in a while to avoid BIG costs that may come up as a result of your negligence.

The list is not exhaustive, obviously.

Think about your own property and what other points you can add to the list and get to work!

If you do the management yourself it’s all in your hands but if you use a management firm then you can definitely instruct them to do the job right and tell them the measures to take!

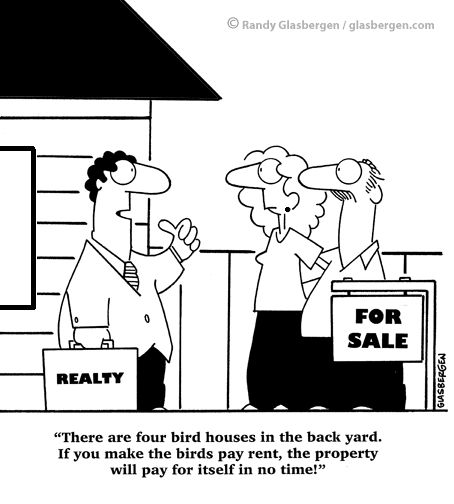

3) Look For Income-generating Opportunities

There are plenty of opportunities everywhere, you just need to look for them and exploit them! If you own a multifamily real estate investing building with several units in it, the scope for improvement could be huge…

Now, the point is: how often do you take a walk at your real estate premises and inspect it for the opportunities that you may have missed?

The people who make it big in buying property and real estate have one thing in common…

“They keep in touch with their property and keep up-to-date with the developments in the market.”

Take a good look at your property and see what unused areas are there that could be put to some use to increase your real estate income.

For example, there are empty spaces within the perimeters of most plots, so why not use them for some sort of recreational activity for the residents and demand a 10% higher rent in return for instance?

Most residents are happy with such developments and will agree to pay at least $100 more per flat. Also, such cosmetic luxuries will attract new tenants to your property.

It’s all about optics after all!

4) Drive Out the Troublemaking Residents!

By trouble-making residents, I don’t mean the defaulters – although they’re too making lots of trouble for you.

By the trouble-makers, I mean the ones who have got a bad reputation among other residents of the building and who often get into fights or altercations…

This is very important!

Tenants who make other residents of your building feel insecure and at some kind of risk should be evicted from the property at once. They are a serious risk and also picture a bad image for the building in terms of marketing.

Many owners hesitate to remove the troublemakers as they think of the rent foregone. If you too think this way, you’ll pay for it someday.

Also, background checks for tenants are incredibly important to make sure there are no closet criminals or terrorists residing in your premises (9/11 terrorists were tenants somewhere in NYC, weren’t they?).

Because, after all, it’s you who’ll have to pay for the consequences.

5) Advertise More Effectively

Now let’s touch on a very important aspect of each and every business: advertising!

With some 43 million rented housing units in the United States only, the competition is neck and neck in this business.

And, precise advertising is all the more important now!

So, how do you advertise your open-for-rent condos or turnkey investment properties? Is your method of advertising effective enough to get you the number of tenants you desire to have?

Let me say that real estate advertising is actually much easier than you think it is! If your current methods of advertising are not delivering the results stop using them and follow my advice.

Take These Steps to Grab More Tenants

– Hire a reputable copywriter who has expertise in real estate marketing and have him write juicy ad copies for you to attract tenants to your property. (You could publish the ads on social media groups or disperse the ads as flyers in hot markets)

– Use newspaper classifieds to let people know about the flats or houses open for rent.

– Get into long-term partnerships with local real estate agents who will get you the tenants and take their cuts (one-time outflow = consistent inflow, the choice is yours!)

– Put up banners that clearly say ‘Available for Rent (or Investment Property for Sale)’ wherever you can and ideally someplace where the potential tenants will have the least chance of missing out on it.

– If you’re willing to invest in long-term benefits then you could even run low-budget TV ads or YouTube ads marketing your property business.

There are 101 ways you can improve your advertising in this digital era…

All you need to do is look for and remove the obstacles that keep you from getting noticed by potential clients because people are always looking for safe and pleasant homes everywhere!

6) Keep Investing in Viable Opportunities

You can always keep the money rolling in by investing in the right kind of opportunities.

There are plenty of investment opportunities out there and if you just spend as little as 5% of your rental income on those opportunities you can bring back home double the amount you invested.

What you want to do is meet the right kind of people, legit investment agencies, stocks, bond brokers, and banks, and tell them that you want to invest!

They will lay out the plan for you and negotiate the terms with you…

If the plan sounds viable go for it!

Many people think investments are risky, which is not true. Only risky investments are risky — too big an investment and too little security.

Get yourself familiar with the process of how investors buying homes by putting in small amounts first.

Once your little investments pay off well, you’re in the game for good! You’ve gained confidence and now you’ll automatically make big investments for bigger returns.

7) Fix and Flip if That’s Profitable

I, personally, don’t rely much on fixing and flipping which means buying a house or building, fixing it, and then selling it at a higher price.

If you buy a property the best strategy is to rent it up, manage it well, and earn passive income over your life!

But, there are times when it wouldn’t be logical enough to hold the property, and selling it off seems like a better option.

For example, when the current or future costs of running the property are more than the profits you’re earning (negative NPVs) or most of the units are empty and no one seems interested in renting them.

Then it’s probably time for you to sell it up…

*Negative NPVs do not necessarily mean you’ll lose in the long run!

To sell for maximum profits first hire a construction engineer and get the estimate to get the property fixed up. At least make the necessary repairs and give the structure an attractive outer look.

Usually, the potential buyer will look at the potential future real estate income (less the expenses) he can generate from the investment and then make his offer.

So, make sure he gets the impression that the future of the property is promising by showing the brighter side. For this, you may want to hire a skilled marketing person to do that for you — they can sell anything, you see!

There’s Always Room for Improvement…

The real estate rental industry is expected to grow by leaps between 2025 and 2030.

The market is on the rise and by following the strategies discussed above you can make your real estate earnings sky-rocket in just a matter of days. For instance, if you buy rental property or invest in rental property USA.

There are no specific, hard, and fast rules about making money in investment real estate.

In this (or any) business you learn and improve at every step.

You make money when you manage your lands and properties to your best potential and you lose when you neglect your holdings. That’s all!