Managing your finances can feel like a juggling act, but when you master it, life just clicks.

That’s why we’re here to learn from the best: the money gurus who’ve cracked the code on making money work for you. Whether you’re starting with $100 or $100,000, these seven tips will get you thinking like a pro, helping you track income and expenses.

Let’s dive into their wisdom and discover actionable ways to boost your financial game by organizing your finances.

1. Budget Like a Boss: Dave Ramsey’s Envelope System

If money management feels like a chore, Dave Ramsey might just change your mind. His legendary Envelope System is simple: allocate cash into envelopes for specific expenses—like groceries, rent, and entertainment. Once the envelope is empty, you stop spending.

This method forces you to live within your means and get a crystal-clear view of where your money is going. Dave’s story is inspiring: after going bankrupt in his twenties, he rebuilt his fortune by sticking to smart financial habits like budgeting.

Takeaway? Start managing your money by tracking every dollar today. Track your expenses with apps like YNAB (You Need A Budget) are modern-day digital envelopes to help you stick to the plan.

2. Pay Yourself First: Robert Kiyosaki’s Wealth Wisdom

Robert Kiyosaki, the mastermind behind Rich Dad Poor Dad, emphasizes a simple but game-changing concept for personal money management: pay yourself first. This means setting aside money for savings and investments before paying bills or indulging in splurges.

Why does this work? It creates a habit of prioritizing your financial future. Kiyosaki often shares how his “rich dad” (a mentor figure) taught him to buy income-generating assets like rental properties, instead of liabilities like flashy cars.

Start small—maybe it’s automating 10% of your paycheck into a high-yield savings account or an index fund. Over time, that money grows and works harder for you.

3. Cut the Fat: Suze Orman’s No-Nonsense Approach

If Suze Orman were your financial fairy godmother, her first piece of advice would be: “Stop wasting money!” She’s all about trimming unnecessary expenses so you can redirect funds to build wealth and that’s actually the best way to manage money.

For instance, do you really need all those subscription services? Or could that daily $7 latte habit turn into an extra $200 monthly toward your debt or investments? Suze often cites the power of compound interest: $200 invested monthly at an 8% annual return grows to about $60,000 in 15 years.

Cutting back doesn’t mean deprivation—it means prioritizing what truly matters: financial wealth management.

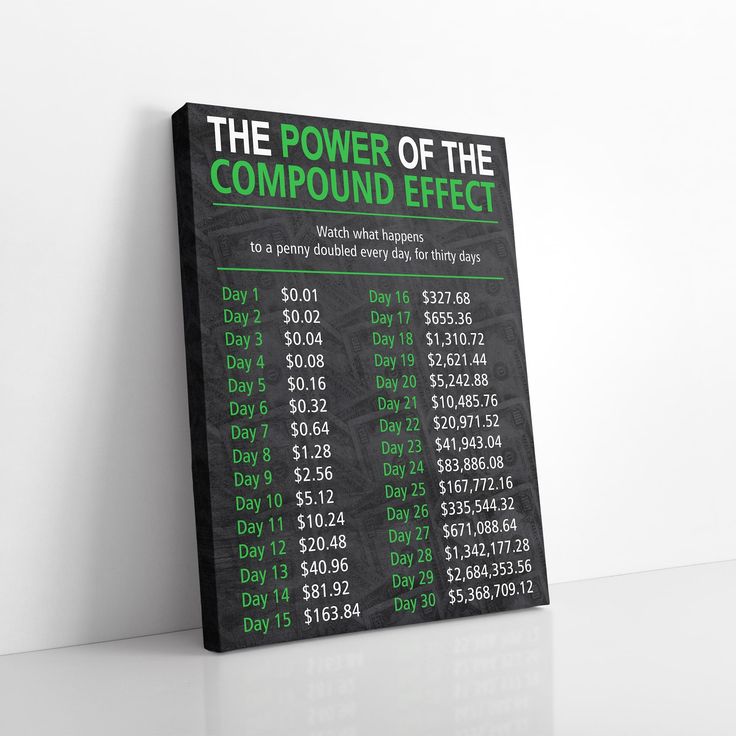

4. Invest Early and Often: Warren Buffett’s Golden Rule

The Oracle of Omaha himself, Warren Buffett, lives by a simple mantra for managing your finances: “Time is your friend, impulse is your enemy.” Buffett started investing at age 11 and attributes much of his success to the magic of compounding over time.

Imagine you invest $1,000 at an 8% annual return. In 10 years, that grows to $2,158. In 30 years? $10,936. The earlier you start, the bigger your snowball grows.

Don’t worry about picking the next Apple or Tesla—index funds are a beginner-friendly way to start building wealth. One of the best ways to manage money, you just keep adding to your portfolio consistently and watch your money multiply.

5. Diversify and Don’t Panic: Ray Dalio’s Portfolio Strategy

Ray Dalio, founder of Bridgewater Associates, is all about balance. To all those asking, how to manage my finances, his All Weather Portfolio philosophy teaches us to diversify investments across asset classes like stocks, bonds, and commodities. Why? To weather any financial storm.

Dalio often says, “The biggest mistake investors make is to think what happened in the past is likely to persist.” Markets will always fluctuate.

So, instead of panicking during downturns, trust your diversified strategy. Even with $500, you can start small with ETFs that spread risk across industries and regions. It’s the best way to manage money. Just, stay calm, stay consistent, and let time do the heavy lifting.

6. Build Multiple Income Streams: Grant Cardone’s Hustle Mentality

Grant Cardone doesn’t believe in relying on a single paycheck. He’s a big advocate for creating multiple income streams – managing your money to build financial security and freedom. From rental income to side hustles and dividend-paying stocks, the goal is to have money flowing in from various sources.

Cardone’s story of scaling from broke to multimillionaire highlights the power of reinvesting profits. For instance, let’s say you start freelancing or renting out a spare room on Airbnb—use that extra cash to buy assets or grow your business.

The hustle isn’t just about grinding; it’s about creating systems that earn and help managing money even when you’re not working.

7. Master Your Mindset: Tony Robbins’ Financial Blueprint

Tony Robbins, motivational powerhouse, believes that strategic financial management starts in your mind. In his book Money: Master the Game, he emphasizes that financial success isn’t just about numbers—it’s about psychology.

Robbins teaches the importance of focusing on abundance rather than scarcity. Instead of saying, “I can’t afford it,” ask, “How can I afford it?” This shift sparks creativity and solutions.

For example, you might find ways to save $50 a week or launch a small online store. The key is to take consistent action, no matter how small, and keep pushing toward your goals.

Managing Your Finances: Your Roadmap to Financial Freedom

The beauty of these tips? They’re not mutually exclusive. You can budget and track your spending like Dave Ramsey, invest like Warren Buffett, and hustle like Grant Cardone—all while mastering your mindset like Tony Robbins.

The big takeaway to organizing your finances is to start where you are.

Whether it’s cutting back on takeout or putting your first $50 into an ETF, every small step builds momentum. Over time, these habits compound into real wealth—and more importantly, the freedom to live life on your terms.

So, what’s your next move? Try one tip today, and you’ll thank yourself tomorrow. After all, when you learn how to manage your money like a guru, the sky’s the limit.