Investing in stocks can feel like stepping into a maze with no map, but learning from the master himself, Warren Buffett, can guide you toward the gold at the end. Known as the “Oracle of Omaha,” Buffett turned Berkshire Hathaway into a stock market behemoth and built a personal fortune through smart, deliberate choices.

Ready to invest like Warren Buffet? Let’s break down the Warren Buffett investing strategy step-by-step with practical examples to get you started on your money-making journey.

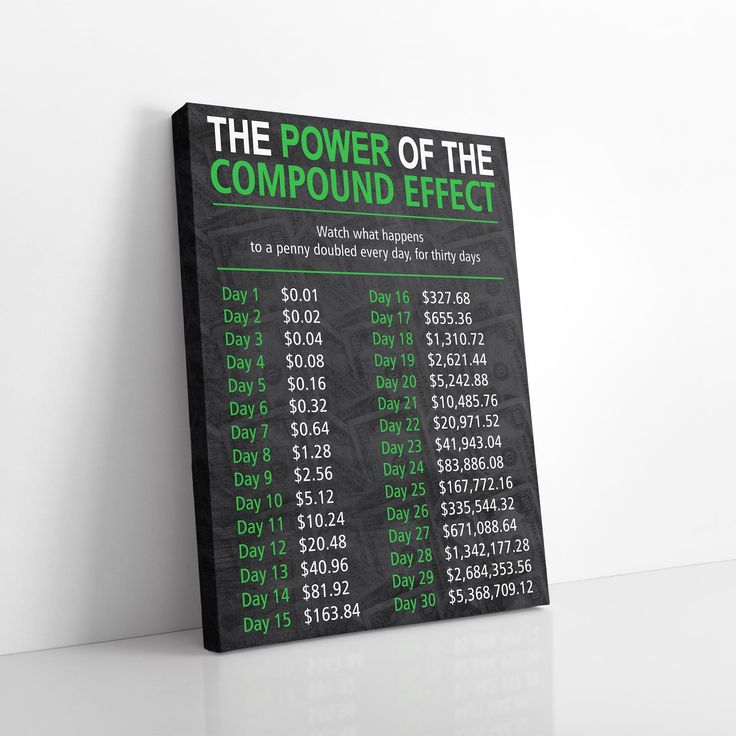

1. Understand the Power of Compound Interest

Warren Buffett investing strategy leverages interest, of course.

Buffett often describes compound interest as the eighth wonder of the world, and his career proves its magic. This principle allows your money to grow exponentially over time as you earn returns on both your initial investment and the reinvested earnings.

For example, imagine you invest $10,000 in a stock that grows by 10% annually. After one year, you have $11,000. But here’s the beauty: in the second year, your 10% growth applies to $11,000, not just your original $10,000. Over decades, this snowballs into massive growth.

Buffett didn’t start Berkshire Hathaway with billions; he started small and let compound interest do the heavy lifting. So, to invest like Warren, think long-term and reinvest your dividends—it’s like planting a money tree that grows bigger every year.

2. Invest in What You Understand

Buffett is famous for avoiding “hot” industries he doesn’t grasp. Instead, Warren Buffett equity portfolio featrues businesses with clear models. His investments in companies like Coca-Cola and McDonald’s weren’t because they were trendy—they were because he understood their products and customers.

Let’s say you’re a tech enthusiast and know how smartphones are evolving. You might focus on companies like Apple or Qualcomm. But if you’ve never followed biotech or cryptocurrency trends, it’s probably not the place to put your money.

A good litmus test? Can you explain to a friend how the company makes money and why people need its products? If not, move on.

3. Look for “Moats” Around Companies

A moat, in business terms, is a sustainable competitive advantage that protects a company from competitors. Warren Buffett stock picking depicts his love for companies with strong moats, like Apple, which enjoys brand loyalty and a high barrier to entry for rivals.

Think about Starbucks. It’s not just about coffee—it’s about the experience. Competitors can replicate the drink but not the vibe. Similarly, Disney has its intellectual property moat; no one can copy Mickey Mouse or Elsa.

When researching a stock, ask: What makes this company hard to compete with? A wide moat means the company can defend its profits even in tough times.

4. Embrace the Art of Patience

Buffett’s favorite holding period? Forever. Stocks Warren Buffett likes are those that fruit in the long term. He doesn’t buy stocks expecting to flip them for quick gains; he invests in businesses he believes will thrive decades down the line.

For instance, during the 2008 financial crisis, while others panicked, Buffett doubled down on bank stocks, understanding they would recover with time. Fast-forward a few years, and those investments paid off handsomely.

Investing isn’t a sprint; it’s a marathon. If you panic-sell when the market dips, you’re locking in losses. Think like Warren Buffett — if you’ve done your research and believe in the company’s long-term potential, hold on tight.

5. Find Bargains Through Value Investing

To imitate Warren Buffett strategy on investing learn value investing.

Warren Buffett’s equity portfolio shows value investing is Buffett’s bread and butter. It means buying stocks that are undervalued compared to their intrinsic worth. Think of it like shopping for designer shoes at a thrift store—you’re getting something valuable at a discount.

Buffett evaluates a company’s fundamentals: earnings, assets, and growth potential. One classic tool is the price-to-earnings (P/E) ratio, which compares a company’s stock price to its earnings per share. A lower P/E ratio often signals a bargain.

For example, let’s say two companies, A and B, both earn $5 per share. Company A’s stock costs $50, while Company B’s costs $25. B’s P/E ratio (5) is half of A’s (10), potentially making it a better value.

6. Don’t Follow the Crowd

Warren Buffet investing style is NOT follow-the-crowd or what’s hot.

Buffett famously advises, “Be fearful when others are greedy and greedy when others are fearful.” Translation? Don’t chase trends.

Remember the dot-com bubble? Everyone was piling into internet stocks in the late ‘90s, only to see them crash spectacularly. Buffett stayed out of the frenzy because he didn’t see long-term value. On the flip side, he bought stocks during market downturns when everyone else was panicking.

A practical takeaway from Buffett’s investment strategy? When you see headlines screaming about the next “can’t-miss” stock, take a deep breath and do your research. Often, the best opportunities are the ones no one’s talking about.

7. Diversify, but Don’t Overdo It

To invest like Buffet, adopt diversification. Buffett believes in diversification—but only to a point. He once said, “Diversification is protection against ignorance.” His focus is on knowing his investments inside and out, which allows him to concentrate on fewer stocks.

For beginners, start with diversification to spread your risk. For example, if you have $10,000 to invest, put it into a mix of industries—tech, healthcare, and consumer goods. But don’t go overboard; owning 50 stocks you barely follow is worse than owning 10 you know well.

One easy way to diversify is through ETFs (Exchange-Traded Funds). These are like investing in a basket of stocks rather than individual ones, making them perfect for beginners.

8. Read, Learn, and Stay Curious

Buffett reads for hours every day, absorbing financial reports, news, and books. His advice? “The more you learn, the more you earn.”

Make it a habit to stay informed. Start small: read a company’s quarterly earnings report or follow market trends on reputable websites. Not sure where to begin? Buffett investment philosophy recommends classics like The Intelligent Investor by Benjamin Graham.

Here’s a fun example: Say you’re interested in electric vehicles (EVs). Read up on Tesla, Rivian, or BYD. What are their market shares? How do they plan to grow? The deeper you dive, the smarter your investments become.

9. Control Your Emotions

Stock prices move up and down like a rollercoaster, but Buffett never lets emotions drive his decisions. His success lies in his ability to stay rational, even during market chaos. So, to invest like Warren Buffett, be in control of your emotions.

Let’s say you own stock in a solid company, but its price drops 10% after bad news. The emotional investor panics and sells, but the Buffett-inspired investor evaluates: Has the company’s value really changed? Or is this just short-term noise?

If the fundamentals are strong, stick with it. Emotional investing leads to impulsive decisions, which often result in losses.

10. Think of Stocks as Pieces of Businesses

To learn to invest like Warren Buffett, know the meaning of stock.

Buffett doesn’t see stocks as mere symbols on a screen; he sees them as ownership in real businesses. This mindset changes how you invest—you’re not just buying numbers; you’re buying into a company’s future.

Imagine you’re considering buying stock in Nike. Think of it as owning a piece of a brand worn by millions globally. How’s their marketing? Are sales growing? This perspective pushes you to dig deeper into what makes the business tick.

This is Warren Buffet stock strategy. So, when you view stocks this way, you’re less likely to panic during market dips. After all, businesses don’t collapse overnight, and solid ones rebound stronger.

Final Thoughts – Invest Like Warren Buffett

Investing like Warren Buffett isn’t about chasing quick riches; it’s about patience, discipline, and a solid understanding of the companies you’re investing in. Whether you’re starting with $500 or $50,000, these principles can set you on the path to long-term success.

So, grab a notebook, pick a few companies to study, and start small. Remember, to invest like Warren Buffett you need to believe in yourself and simply start. Buffett’s empire began with his first few dollars—and yours can too!